Frequently Asked Questions About Turnkey Properties

Find answers to your common investment questions with Turnkey Properties.

Contents

What parts of town do you invest in? Do you offer a home warranty after the purchase? What does a typical scope of work look like for a Turnkey Properties renovation? What makes Memphis Turnkey Properties different from other turnkey providers? Where do you see Memphis Turnkey Properties in five years? How can I overcome my objections to investing out of state? Do you have a portfolio of homes? Do you own the homes you sell? Does “turnkey” mean paying more than the appraised value? Can I buy a turnkey home with a deep discount?

What parts of town do you invest in?

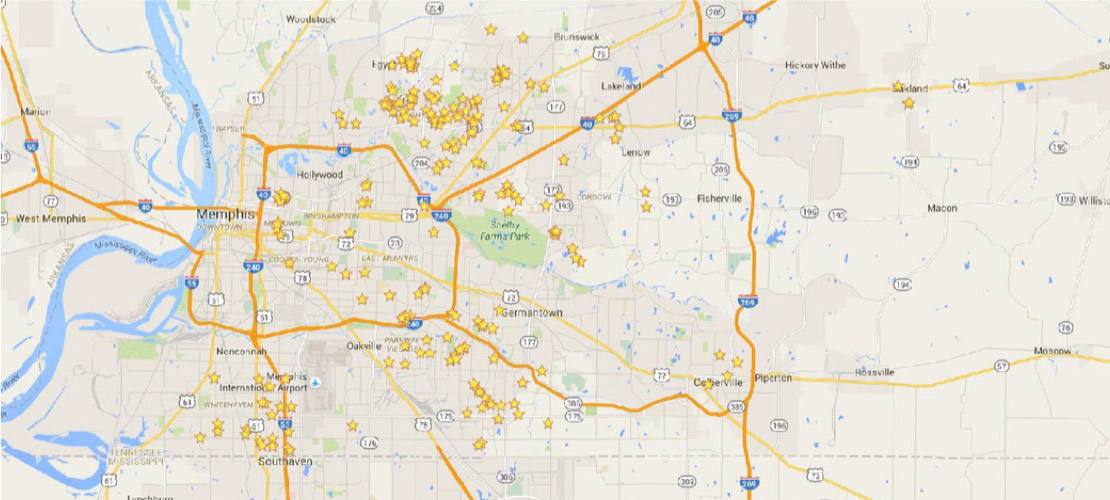

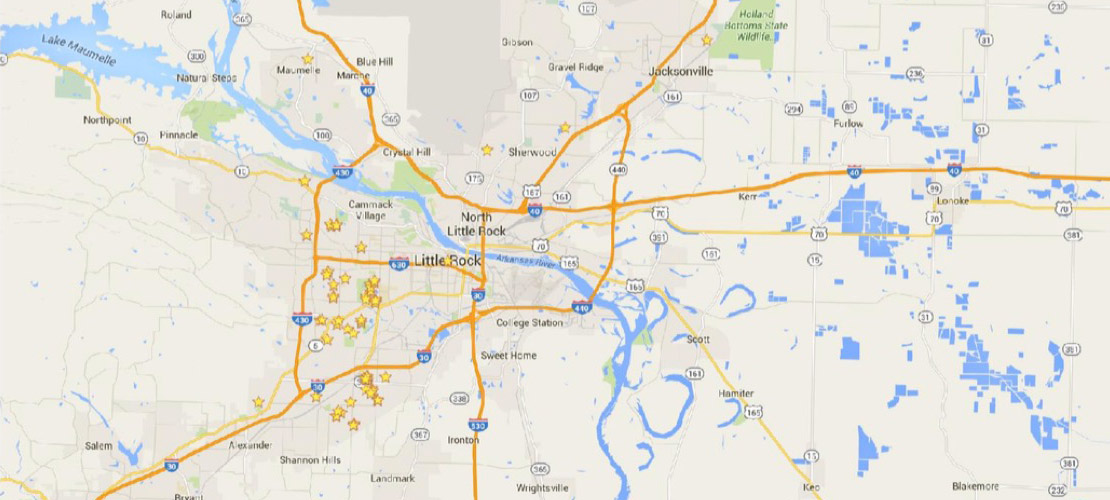

We buy in strategic areas of Memphis and Little Rock where we have a track record of success. Typically the rents in these areas are $895 and above.

Rents and values generally follow each other; in most cases, a $750 home will not be in a $90,000 area, nor will a $950 home be in a $65,000 area.

The maps below show a track record of where we have bought homes since 2013.

Memphis Properties

Little Rock Properties

Do you offer a home warranty after the purchase?

We offer a 90-day warranty within the four walls of the home and 180 days warranty on the HVAC system.

Our goal is to sell you a home with very little maintenance required in the first few years of ownership, which we have successfully achieved. With most homes we purchase in a distressed state, even with our renovation and the buyer’s home inspection, we are realistic about potential issues that may arise after move-in.

Most houses we sell have new HVAC systems with a manufacturer’s warranty.

Our vendors cover anything we work on during the rehab for one year. In other words, if we installed a faucet and that faucet leaks, we would cover that for the first year.

What does a typical scope of work look like for a Turnkey Properties renovation?

We do an extensive rehab for every house we offer. Looking at our completed projects, you will notice that all the houses look similar. That is because regardless of the condition of certain items, we replace them with our spec items.

For example, we have bought homes with brand new carpets in the living room and den only to pull them up and install vinyl plank flooring because we know it will save our investors thousands over the property's lifespan.

Our typical scope of work includes:

- Ceramic tile in the kitchen

- New countertops

- Designer ceiling fans in the den/living room and primary bedroom

- Faucets replaced with brushed nickel designer faucets

- New light fixtures installed throughout

- Painting the interior/exterior

- Blinds

- Bathroom mirrors in bathrooms

- Landscaping and exterior improvements

We also address deferred maintenance such as tree limbs over the house, faulty gutters, inadequate irrigation, and fence issues.

Our goal is to provide the best-looking rental home in our market that will attract tenants and reduce maintenance. On average, if we put on a roof and install a new HVAC system and hot water tank, we are spending $25,000 to $30,000 per renovation.

What makes Memphis Turnkey Properties different from other turnkey providers?

We believe we are unique in our market in several areas. While we don't have insight into every company, we feel that our homes are the nicest rental homes on the street, and our property management is innovative with great customer service.

We've taken over management from several other turnkey providers' management companies, and one trend is that other companies ignore deferred maintenance.

That means tree branches over the house, external structures, and fences are often overlooked. At Memphis Turnkey Properties, we address all of those issues and more.

From an acquisitions standpoint, we see many other turnkey companies buy houses throughout much larger areas while we strategically select our locations. Other aspects that make us stand out include our customer service and constant conversation regarding how we can take it to the next level.

Where do you see Memphis Turnkey Properties in five years?

We get this question all the time. We have been buying rental homes since 2007 and have no plans to quit. The model of how our company does business has dramatically changed since we first started to keep up with market evolution.

There is no doubt that there have been challenges along the way, but being able to adapt is crucial in any business. In the past three years, we added Little Rock to our market and started offering multi-family deals to our investors in the past year.

In the next five years, we plan to build on our success while watching the real estate market closely to stay relevant and evolve as necessary. We see ourselves doing larger multi-family deals and continuing to grow our property management company.

We love what we do in real estate and plan to be in this business for decades. As a family-owned business, our foundation is strong, and we plan to carry on our mission throughout the generations.

How can I overcome my objections to investing out of state?

Our entire business model offers complete services to out-of-state investors. It's what we do daily. We encourage all our investors to visit the market and meet our team; that helps most new investors overcome their fears of out-of-state investing.

Next, we encourage all our investors to order a home inspection to ensure they are not buying a maintenance money pit. Most of our investors typically purchase property with conventional financing, which requires a third-party appraiser to verify the home's value.

Our property management team makes every attempt to be transparent. We scan and upload anything we can, such as material receipts, manufacturer's warranty, vendor invoices, and "before and after" pictures of our repairs, and inform investors regarding every maintenance call that comes into our office.

If you still have questions or concerns about anything, call us, and we will walk you through any concerns. The bottom line is that this is a relationship business, and we desire to form these relationships on the front end to have a great long-term partnership.

Do you have a portfolio of homes?

Absolutely! It says something if those you consider buying any financial product from, including real estate, are not actively vested. Currently, among ownership, we have more than 50 units in Little Rock and Memphis.

We founded our business on the simple concept of doing what we're good at and offering those services to our clients. We continue to purchase for ourselves and seek to have all our units paid for over the long term.

Do you own the homes you sell?

Yes, we go on the title of everything we sell. After the purchase, we will rehab the property to sell the home to another investor.

Typically we are on title for 90 days as that is our cycle to buy, renovate, and sell.

Does “turnkey” mean paying more than the appraised value?

No, you should never pay more than the value of the home. We will never expect you to pay more than the house is worth as that is unnecessary. We provide a high level of service and great product without asking you to overpay.

When providing 100 deals a year to our investors, realistically, not every property can be profitable from our end. We acquire several properties a year, knowing the margins are slim, but we feel they are a good opportunity for our investors.

Flipping homes to investors is much different from flipping homes to owner-occupants on cable TV.

Can I buy a turnkey home with a deep discount?

Sometimes, but most of the time, no. To get deep discounts, you would need to purchase direct and facilitate the renovation, which is not our business model and not what our clients are seeking.

With the turnkey model, when working with a responsible turnkey provider, the home's premium price is often close to the appraised value. This is because our investors are seeking a passive investment that is only possible if the home's renovation is done correctly and all deferred maintenance items are addressed.

It is virtually impossible to provide a high-quality product that will maximize cash flow when you cut corners.

An excellent example is looking at two hypothetical properties next door to each other. House #1 is being sold for $70,000, and house #2 is being sold for $80,000.

- House 1 has a 15-year-old roof and 15-year-old HVAC system with carpet throughout and vinyl-rolled kitchen flooring.

- House 2 is renovated retail for the area, with a new roof, new HVAC, ceramic tile in the kitchen, and vinyl plank flooring in high-traffic areas.

Which house is going to produce more cash flow?

- House 1 has almost $9,000 in deferred maintenance within the first five to seven years of ownership, which could eat four years' worth of cash flow, not to mention replacing the carpet in the high-traffic areas every two to three tenant turns.

- House 2 will provide more cash flow through less maintenance, as the large capital expenses are extended by 15 to 25 years.

By then, your property could be paid off, or you could consider refinancing and taking the equity out tax-free to improve your property or invest in more real estate.

If you use financing to purchase the home, that $10,000 in upgrades only costs $2,000 to $2,500 in additional out-of-pocket costs (with a down payment of 20 to 25%).

Schedule a Consult

Schedule a Consult